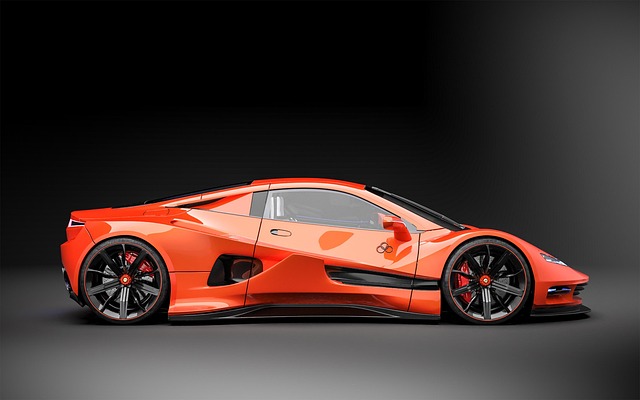

Couples seeking wedding funding alternatives are turning to car title loans for quick cash access secured by their vehicle's value. While offering streamlined approval and flexible payments, these loans typically carry higher interest rates and risk repossession if repayments fail. Considering safer options with potentially lower rates and responsible borrowing practices can help couples manage costs and build credit.

Planning a grand wedding but need financial assistance? Considering a car title loan as a funding option? This guide explores whether tapping into your vehicle’s equity through a car title loan is a practical solution for covering large wedding expenses. We’ll delve into the pros and cons, compare it to alternative funding sources, and help you make an informed decision for this special occasion.

- Exploring Car Title Loans for Large Weddings

- Pros and Cons of Using Car Equity for Wedding Costs

- Alternative Funding Options to Car Title Loans for Weddings

Exploring Car Title Loans for Large Weddings

Planning a large wedding can be an exciting yet expensive endeavor. For couples facing financial constraints, exploring alternative funding sources might be necessary to make their dream day a reality. One option gaining traction is using a car title loan for wedding costs. This type of loan allows individuals to access a substantial sum of money secured by the value of their vehicle. With quick approval processes and flexible payment plans, it presents an appealing solution for those seeking financial assistance with wedding expenses.

Car title loans offer several advantages when it comes to large weddings. The borrowing process is often more straightforward compared to traditional loan options, as it requires minimal paperwork and has relatively fast turnaround times. This can be particularly beneficial for couples who need funds urgently. Additionally, the ability to repay the loan over a set period with manageable monthly installments ensures that the financial burden doesn’t weigh heavily on the newlyweds right after their wedding.

Pros and Cons of Using Car Equity for Wedding Costs

Using a car title loan to fund your wedding can have its advantages and disadvantages. One significant pro is that it provides quick access to cash, which is especially beneficial if you’re facing unexpected expenses or running low on savings. This type of loan allows you to leverage the value of your vehicle as collateral, ensuring a faster approval process compared to traditional bank loans. It can be an attractive option for couples who need emergency funding and want to avoid piling on credit card debt.

However, there are potential cons to consider. Secured loans like car title loans often come with higher interest rates, which could increase the overall cost of your wedding expenses over time. Additionally, if you’re not careful, you might find yourself in a cycle of taking out additional loans to cover previous ones. It’s crucial to remember that your vehicle is at risk if you fail to repay the loan, as lenders can seize and sell it to recover their losses. This makes it an even more significant decision for couples who value their primary means of transportation or are already struggling with debt.

Alternative Funding Options to Car Title Loans for Weddings

When considering funding for your wedding, it’s essential to explore various options beyond traditional methods. While a car title loan for wedding costs might seem like a quick solution, offering both quick funding and often lower interest rates compared to credit cards, there are alternative routes that could better serve your financial needs. These alternatives cater to different preferences and repayment capabilities while ensuring you have the funds needed without compromising your vehicle’s title.

One such option is exploring secured loans. These are typically backed by an asset, in this case, your car, providing a safety net for lenders. With a secured loan, you benefit from potentially lower interest rates and more flexible repayment terms compared to some car title loans. Additionally, building credit through responsible borrowing and timely repayments can be a valuable strategy for couples planning their wedding expenses.

While a car title loan can provide quick access to funds for large weddings, it’s crucial to weigh the pros and cons carefully. Tapping into your vehicle’s equity may offer relief from immediate financial strain, but high-interest rates and potential repossession risks should not be overlooked. In light of these considerations, exploring alternative funding options like personal loans, wedding-focused financing, or creative cost-cutting measures might prove more beneficial in the long term for a seamless and stress-free celebration without the burden of significant debt.