Unexpected wedding expenses? A car title loan for wedding costs offers fast access to funds using your vehicle as collateral, bypassing credit checks. Eligibility requires being 18+, owning your vehicle, and providing ID, registration, and insurance. Repayment success involves strategic budgeting, debt consolidation, timely payments, and avoiding penalties to boost credit scores.

In the whirlwind of planning a wedding, unexpected expenses can arise, leaving couples scrambling. For those facing financial emergencies or delays in funding their big day, car title loans might offer a solution. This article explores how these short-term, secured loans can help cover wedding costs. We break down eligibility criteria and the application process, offering tips to ensure successful repayment for this unique type of financing.

- Understanding Car Title Loans for Weddings

- Eligibility and Application Process

- Tips to Ensure Repayment Success

Understanding Car Title Loans for Weddings

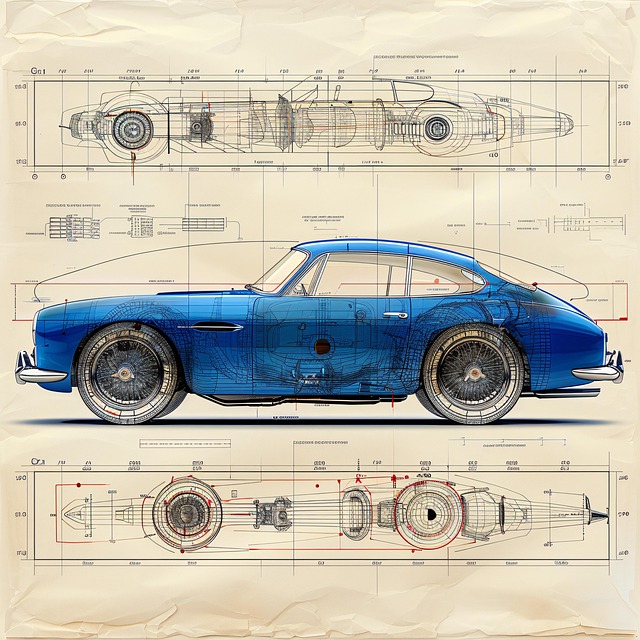

When wedding plans suddenly change or unexpected expenses arise, couples may find themselves needing fast cash solutions to cover essential costs. One option gaining popularity is a car title loan for wedding-related emergencies. This type of loan uses your vehicle’s title as collateral, allowing you to access quick funds without traditional credit checks. The process is straightforward; lenders conduct a brief vehicle inspection to determine the car’s value and then offer a loan based on that assessment.

Car title loans can be particularly beneficial for covering last-minute wedding expenses, such as venue changes, catering upgrades, or unexpected guest arrivals. With flexible payment plans available, borrowers can manage their repayments over an extended period without the usual stress associated with urgent financial needs. This option provides a safety net for couples, ensuring they can celebrate their special day without the added worry of immediate financial strain.

Eligibility and Application Process

When it comes to eligibility for a car title loan to cover wedding expenses, lenders typically require borrowers to meet certain criteria. Applicants must be at least 18 years old and have valid identification documents. Additionally, they should own their vehicle outright, as this serves as collateral for the loan. The vehicle’s registration and insurance records will need to be verified during the application process.

The application procedure for a car title loan is usually straightforward. Borrowers begin by filling out an online application form or visiting a local lender’s office. They will need to provide personal information, such as their name, contact details, and employment status. The next step involves presenting their vehicle’s title, which proves ownership. Lenders may also request proof of income and employment history. Once the application is submitted, an underwriter will review it and assess the borrower’s eligibility based on their financial health and the value of their vehicle. Upon approval, the loan funds can be disbursed, allowing couples to cover unforeseen wedding costs or delays with a Dallas Title Loan.

Tips to Ensure Repayment Success

When considering a car title loan for wedding costs, it’s crucial to have a plan for repayment success. Firstly, determine your budget and create a realistic financial plan that accounts for both the loan amount and any additional expenses. A clear understanding of your funds will help you decide on an affordable loan term and interest rate. Secondly, explore options for debt consolidation if you already have existing debts. Combining multiple loans into one with a lower interest rate can simplify repayment and save money in the long run.

Additionally, keep your vehicle as collateral for the title loan. This ensures quick funding when needed without sacrificing your asset. Regularly review your budget and make extra payments whenever possible to reduce the total interest paid over time. Remember that timely repayments not only help you avoid penalties but also improve your credit score, making it easier to access future loans or financial services.

In cases of unexpected wedding delays or emergencies, a car title loan can provide much-needed financial support. By understanding the process, being mindful of eligibility requirements, and adopting successful repayment strategies, you can ensure that your special day goes off without a hitch financially. A car title loan for wedding costs offers a temporary solution, allowing you to focus on planning while managing cash flow efficiently. Remember, prompt repayment is key to avoiding potential penalties, making this option a practical choice when faced with wedding-related financial challenges.